A Lesson in Bubbles

While the art market is reckoning with recessions, Critical Edge looks at if champagne sales can signal where the contemporary art market is headed?

Ahead of the G20 conference that took place in Indonesia in November 2022, the International Monetary Fund (IMF) provided a report that cast a dark cloud over global economic performance. The report outlined high inflation, weak growth in China, Russia’s invasion of Ukraine, and of course the effect of the Covid-19 pandemic. Europe, particularly vulnerable, is seeing a recession bite.

But on the surface, the art market seemed unaffected. The recent sales of the Paul Allen Collection at Christie’s and the David M. Solinger Collection at Sotheby’s achieved results 35% to 60% above their pre-sale estimates, and give justification to those who argue that the art world sits above all the gloom.

Meanwhile, the luxury industry remains bullish off the back of strong sales in 2021 and 2022. A 2022 forecast from Bain & Co and Altagamma predicted that the personal luxury goods sector will grow 22% from 2021 to 2022, because, despite the economic uncertainty, there is a concentrated wealth in luxury spenders (the top 2% of spenders now account for 40% of sales – up from 35% in 2009), and Gen Z had started buying luxury items five years earlier than millennials (from 15 as opposed to 20 years old).

But one luxury sector – champagne – already might be showing signs that the tides are turning, especially when it comes to speculative buying on the secondary market. From April 2021 to October 2022, LivEx’s Champagne 50 price index grew monthly by 3% on average. But since then, it has dramatically turned course, declining at an equal rate. LivEx creates indexes for wine investors whose approach to investment is not dissimilar to what we have seen a lot in the art world over the past two years – which suggests that champagne sales might also be a leading indicator for the contemporary art market.

Sales of champagne are historically one of the more unusual indicators of recession. The logic is that when times are good, people want to celebrate and splurge – less so during economic downturns. And although the business is not as glitzy or high-profile as the art sales, Christie’s and Sotheby’s sell a lot of champagne on the secondary market. The sales data is rarely scrutinised in the same way as with art sales, despite a crossover in client base.

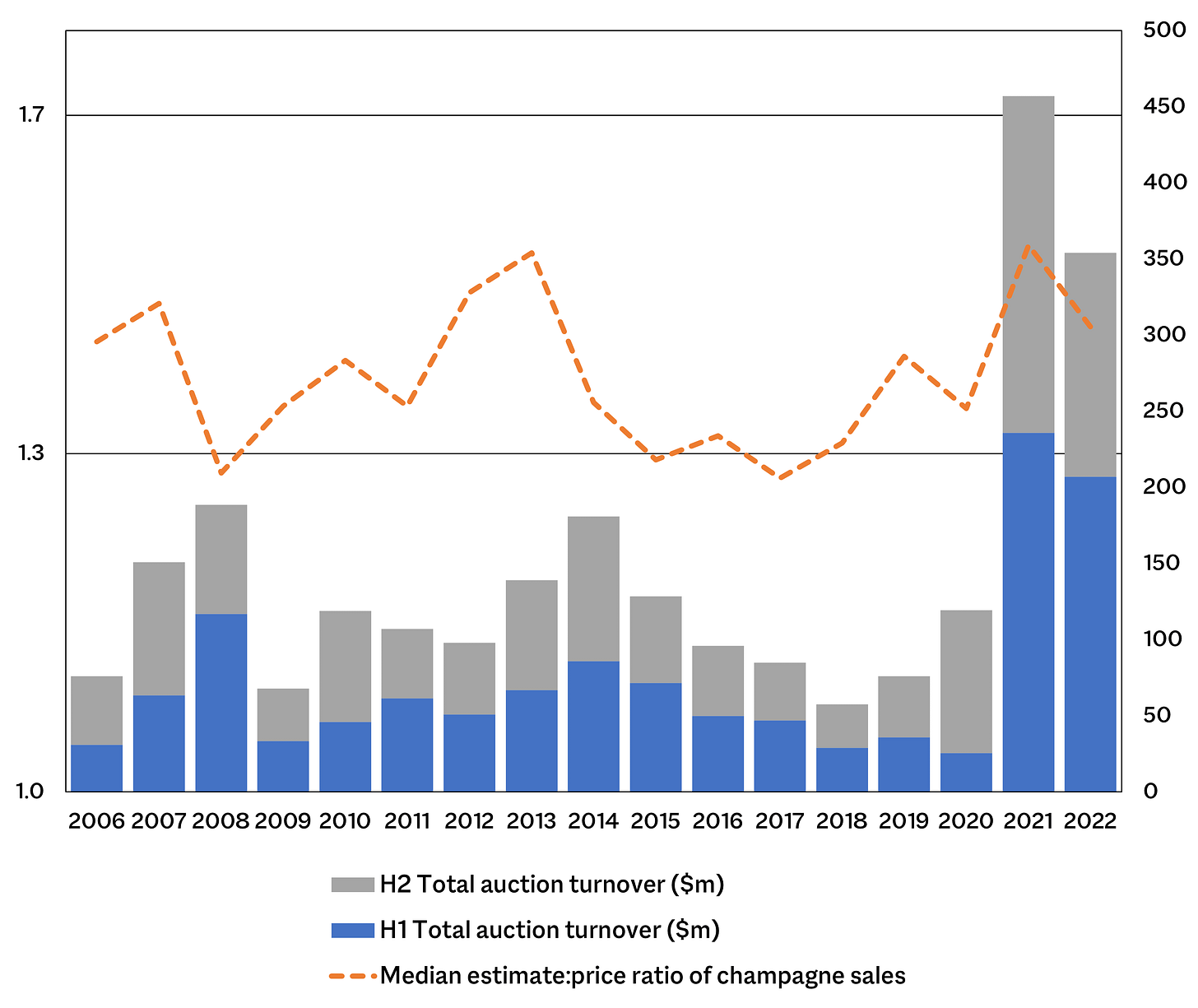

The orange line on the graph above shows the estimate price ratio, which is essentially how the final sale price compares to what the pre-sale estimate was, for a sample of more than 8,000 lots of champagne sold at either Christie’s or Sotheby’s from 2006 to October 2022. This is effectively a reflection of how keen the bidding was – in other words, buyer demand.

The data shows that champagne was in low demand in 2009 during the post-2008 recession, although it recovered quickly – driven primarily by demand from China, which then crashed in 2014 due to the country’s crackdowns on luxury gifting. Then, in 2021 and 2022, the price of champagne on the secondary market reached another peak. In 2020 and 2021, the two auction houses sold more than 1,600 lots of champagne (which often contained multiple bottles or magnums), double what was sold in 2019 and 2018. But our findings show that there has been a drop in the estimate price ratio, indicating a drop in demand compared to 2021, which could be indicative of a drop as seen in 2008.

We can compare this estimate price ratio against the total turnover of contemporary artists under 40. Importantly, it seems that champagne stops selling well just before the market for emerging contemporary artists falls. And in 2022, despite sales for young contemporary artists remaining at a high (albeit less than 2021), the performance of champagne has lost its fizz slightly.

Similar ‘slowing’ can be seen in trade statistics. The UK is consistently one of the biggest importers of champagne (the US is the leader) to sell on the primary market. In the first half of 2022, the UK’s monthly imports were 49% higher than for the period in 2021, showing significant growth in demand. However, H2 2022 figures saw only a 10% increase, while H1 2023 vs H1 2022 saw a 1% drop. Although modest, this drop is likely indicative of a change in the wind, and indicative of the country’s current economic situation, as it faces ‘the longest recession since records began’, to quote the Bank of England.

There is, of course, a risk of comparing apples and oranges when trying to draw conclusions about the future of the contemporary art market by looking at champagne sales. But there are undeniable correlations between the markets that make it a fitting comparison, especially when it comes to artists under 40.

This may be because champagne and emerging contemporary art share an underlying market driver: speculation. According to Liv Ex, a London-based wine marketplace and insight company, the secondary market for champagne has completely shifted in its characteristics. Before 2021, top, ‘investment grade’ champagnes had seen steady, stable price growth of around 8% a year. There was a balance between what was drunk and what was produced on a yearly basis, meaning that prices were stable. But in recent years, the ‘speculators are active’, according to Liv Ex, and buyers are storing champagne and not drinking it, meaning that oversupply could soon collapse the market.

Looking at the contemporary art market over the same period, we can similarly witness an investor class buying art for the express purpose of making a profit, as opposed to for personal enjoyment, driving up the prices of young artists. Inevitably, profits will want to be realised, markets will be ‘flooded’ and prices will drop.

Champagne sales might then not only be a recession indicator, but also might be a leading indicator in showing where the contemporary art market is headed. And right now, it looks as though the bubbles might well be popping.

Another indicator might not be Christie’s or Sotheby’s but Phillips. Critical Edge has looked before at how day sales can sometimes be better indicators of market shifts than the marquee evening sales. The Phillips 20th-century and contemporary art day sales in November 2022 came in 23% below their expected performance.

But perhaps the one advantage of buying a case of Salon Le Mesnil-sur-Oger Grand Cru 2002 for £13,000 is that if you lose all your money, you can at least try drinking your sorrows away.