How many art collectors are there across the globe?

The are surprisingly few estimates on the number of people driving the demand side of the industry, and those we do have vary wildly. So we crunched some numbers.

The art market is estimated to be a $60 billion industry, and it has been that way since 2006 (give or take 10% and a few economic crashes). As is often pointed out, this figure is small in comparison to, say, the global luxury goods market.

But whereas the number of luxury goods consumers is estimated at around 400 million people worldwide, there are surprisingly few estimates and resources on the number of art collectors driving the demand side of the industry around the world. Even the leading annual art market report created by Art Basel and UBS only speaks to general high net worth individual (HNWI) wealth trends, rather than focusing specifically on art collectors.

But there are clues out there that give some indication of the number of art collectors worldwide.

Some surveys of HNWIs (net worth of $1 million plus) have asked the respondents whether they collect art. The 2017 UBS Investor Watch survey estimated that 15% of HNWIs engage in fine art collecting activity. That same year, the US-focused US Trust Insights on Wealth and Worth put this estimate at a slightly higher 20%. More recently, the 2021 WealthX Interests, Passion and Hobbies report gave an estimate of 7.6% for those with a net worth between $5m and $10m, rising to 35.8% of people with a net worth over $5bn.

These reports suggest that there is anywhere between 1 and 2.65 million people who could easily buy works of art that cost more than $10,000. The online art marketplace Artsy claims to have around 1.7 million users. That platform lists over 1.5 million works of art for sale, 77% of which are under $10,000.

But these collector figures start to look high when you survey art businesses, as in the annual art market reports created by Art Basel and UBS. Their 2022 report estimates that there are around 500 ‘second-tier’ auction houses based in over 250 different cities, who have an average of 1,434 clients each. This provides a maximum of 717,000 clients in total (likely an overestimate due to duplications and the inclusion of decorative arts and other collectibles). The report also surveys commercial galleries and dealers, focusing on established businesses that participate in art fairs. This pool of around 8,000–10,000 businesses has a median of 25 buyers each, giving us a pool of 200,000 to 250,000 gallery buyers. This, again, overestimates, as it doesn’t consider the fact that each collector buys from an average of 17 different galleries.

At the top end of the market, estimates get even smaller. In 2020, Sotheby’s was estimated to have approximately 30,000 clients bidding on all of its sales. One can assume that the numbers at Christie’s and Phillips are similar with a great deal of overlap. But bearing in mind this figure includes all the people bidding on watches and wine, who might have little interest in art, the number of clients for fine art is likely closer to 10,000. Of these, there are thought to be around 1,000 people who can be called upon to spend over $5m on a single work of art, an estimate provided by Georgina Adam in her 2014 book Big Bucks: The Explosion of the Art Market in the 21st Century.

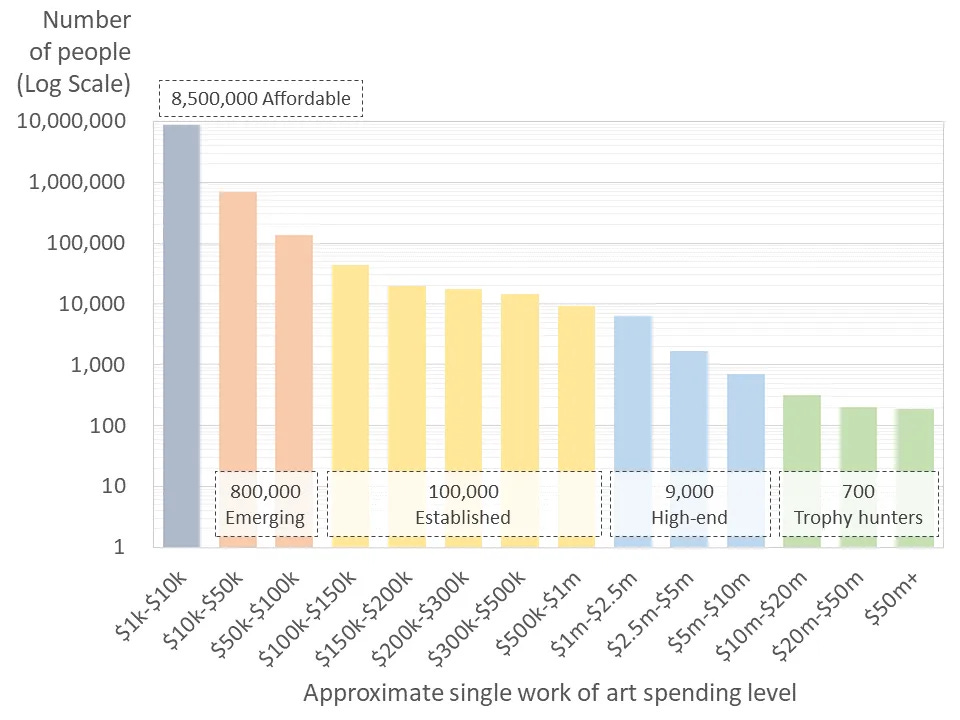

Using the numbers above, as well as other sources, Critical Edge has made an estimate of the number of art collectors in different categories worldwide (illustrated above). Employing a common methodology within the industry, these categories are organised according to the amount collectors will spend on a single artwork, from affordable art collectors to trophy hunters. It appears that art costing under $10,000 has the largest collector base of all. Our estimate has this base at 8.5 million, but this is assuming that those who are less wealthy than HNWIs still have the same enthusiasm for buying art. It may be an overestimate.

Why do these figures matter? In recent years, investors – mostly coming from outside of the art world – have poured significant amounts of money into new art-tech start-ups, often with the goal of ‘democratising’ the art market and massively expanding the number of people buying art. In the first half of 2022, FuelArts estimated that 640 investors gave $2.6bn in funding to 123 start-ups. This is more than 237% of the investment for the whole of 2021.

One such company, Limna, which is specifically targeted at people actively buying art, received over $2.6m in investment between 2020 and 2022. In an interview with FuelArts in June 2022, Limna’s co-founder Marek Claassen stated that its then business model was aiming at 3 million users in 4 years. This wildly optimistic projection means obtaining double Artsy’s users in a fraction of the time, and, by our estimates, 32% of all art collectors.